Digital Times

Our timeline allows you to browse the milestones in the history of IT at our corporation. For the complete picture please have a look at our book on the Evolution of IT at Allianz

1890

Foundation

Allianz Versicherungs-AG started its business in 1890 in Berlin, with the two insurance divisions of marine and accident insurance.

Everyday work in the founding years

In the years that followed, Allianz expanded its business to include other insurance options and established itself as the largest property insurer in Germany by 1913 also as a result of a number of mergers. Surprisingly, the company was able to become the market leader almost entirely without using modern office technology.

Cumbersome workflows and predominantly manual processes were commonplace. Insurance officials worked at standing desks where all documents were handwritten. A policy went through many steps, from application to fair copy, before it was passed on to accounting and the agent. File management through a complex register system proved to be cumbersome and extremely time-consuming.

In a review from the 1930s, board member Rudolf Hensel describes his impressions as follows: although Allianz's business has grown year by year, and is managed in a first-class manner from a financial point of view, the company seemed to him to be backward in terms of administration and organization.

In short, Allianz hardly used the technical possibilities of the time until the 1920s. Modernization was overdue, but it wasn't an issue until the 1920s. On the other hand, many other insurers had already begun to introduce modern technology in the 19th century.

From the 1890s, for example, typewriters were used by Allgemeine Deutsche Versicherungsverein. There, with new office technology, the first women were also employed.

This development had bypassed Allianz.

The First World War brought additional pressure to change. It was not until 1914, when 326 of the 792 employees were drafted as soldiers, that the resulting labor shortage was alleviated by hiring women.

1926

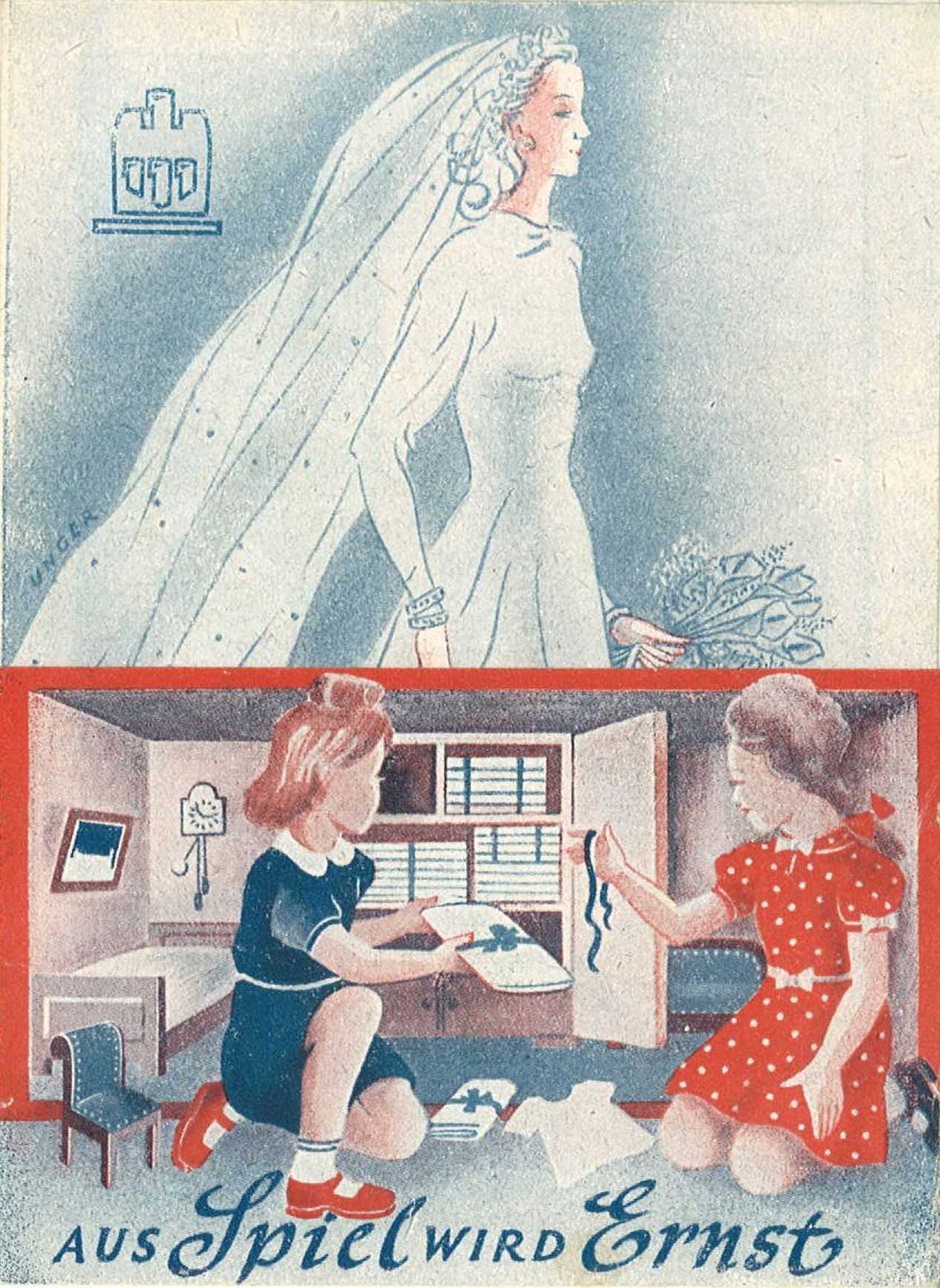

Small life insurance

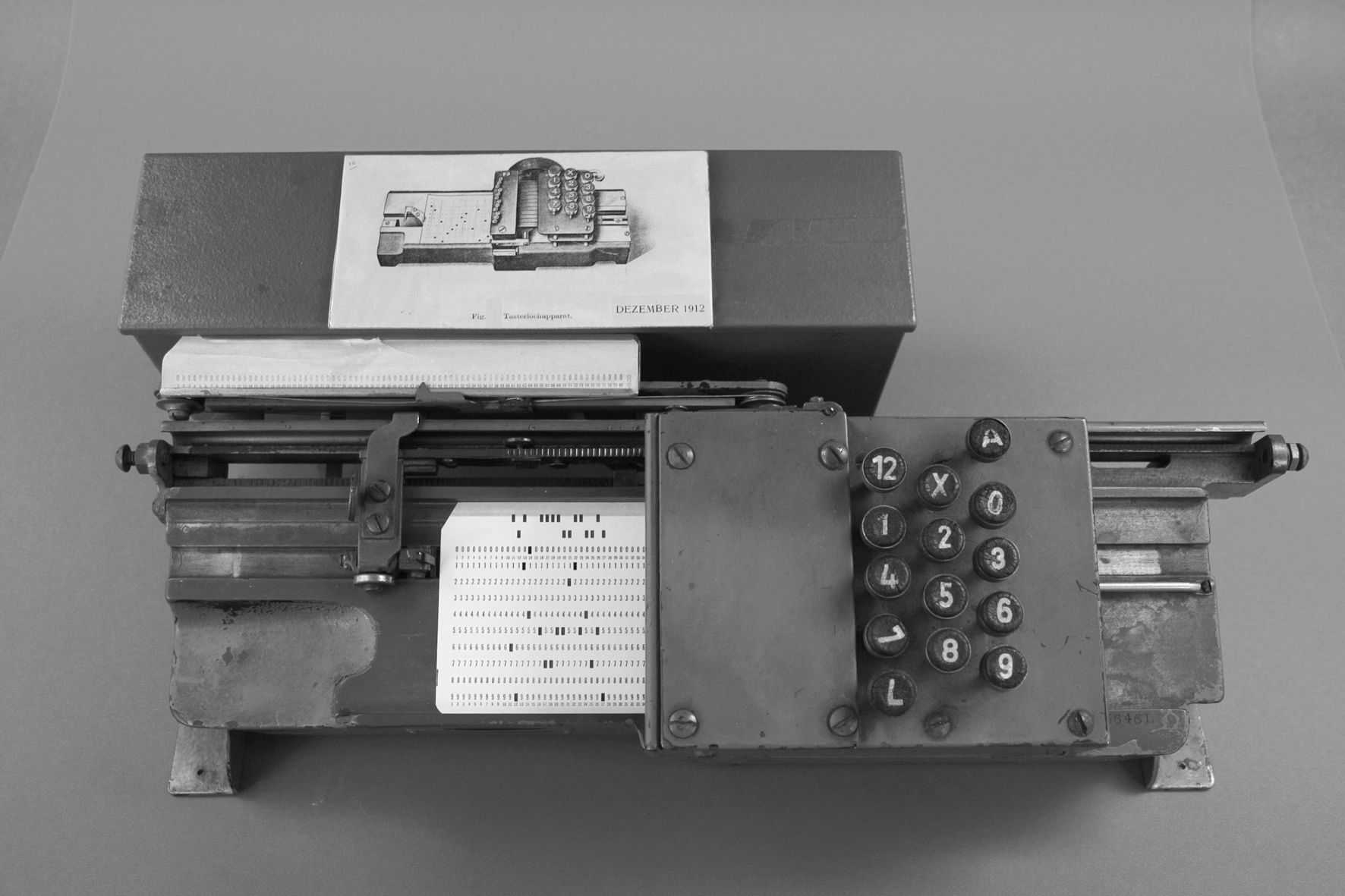

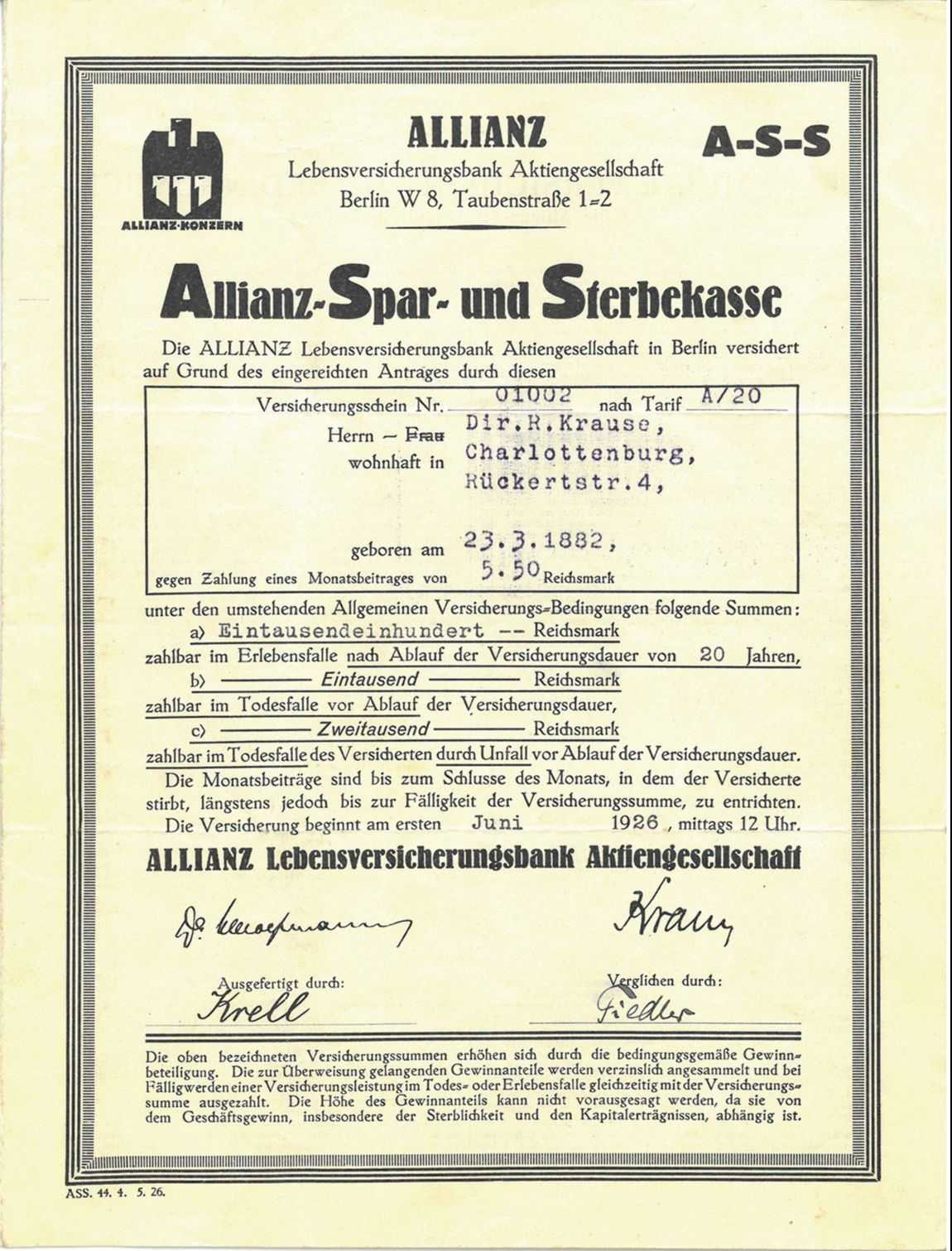

Allianz Lebensversicherungs-AG(Allianz Leben), founded in 1922, was one of the first companies in Germany to use punch card machines for the cost-effective processing of small life insurance policies introduced in 1926.

Mechanical data processing in life insurance

In 1921, driven by the consequences of the war and the onset of inflation, the new CEO Kurt Schmitt initiated a rationalization program in which technology was to play a central role. His new management team developed a whole bundle of ideas and measures for modernization.

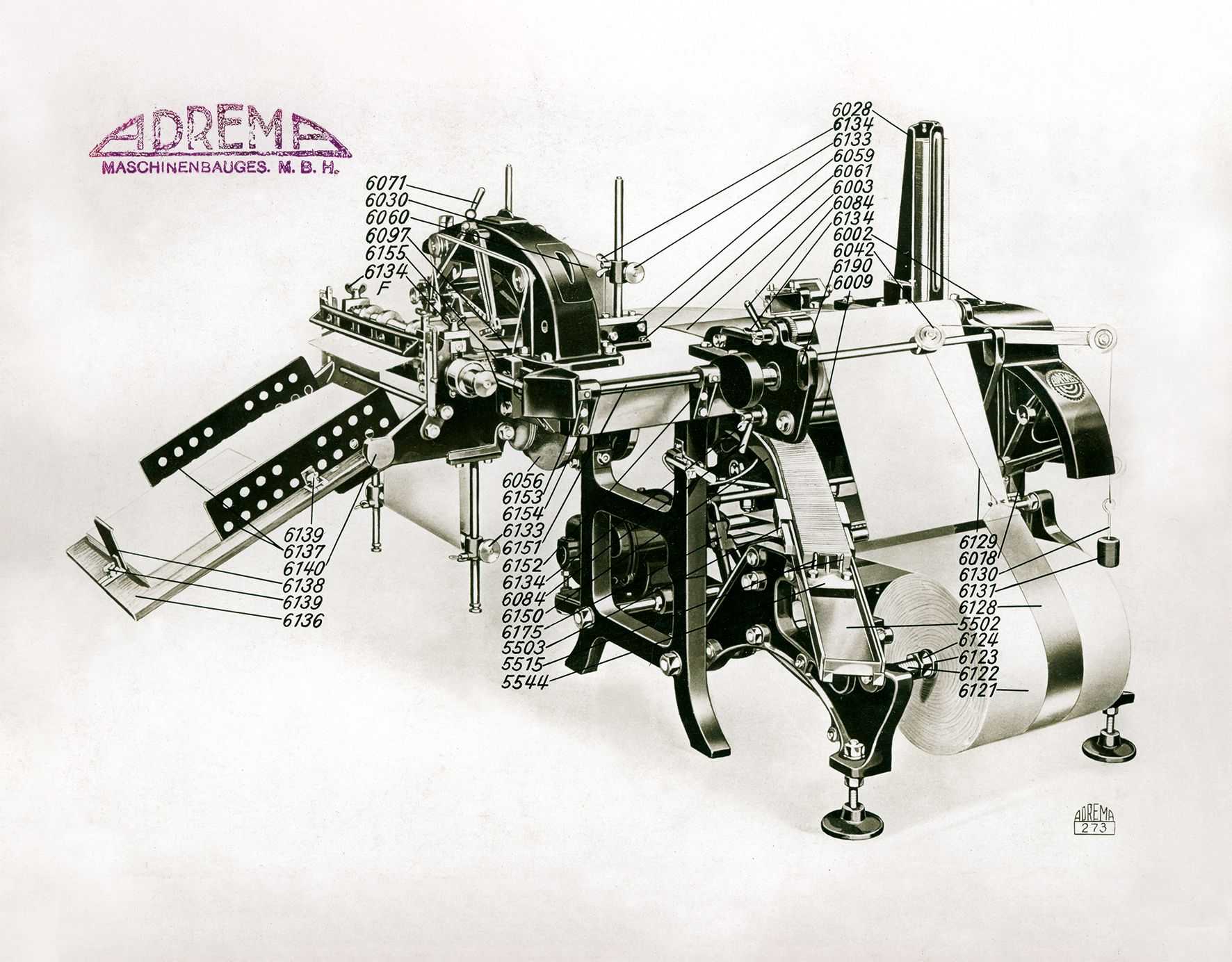

Between 1921 and 1925, Allianz carried out rationalization and mechanization of work processes and working methods. The introduction of modern office technology, ranging from typewriters and accounting machines to Adrema and punchcard technology, became the key to office modernization.

On the one hand, new technology should enable permanent savings in the area of labor - in the wake of inflation, the number of employees was first increased and then sharply reduced in 1923 - and, on the other hand, the employment of additional inexpensive workers who could operate the machines.

In order to win new customer groups for life insurance, Allianz Leben extended its range to include small life insurance policies in 1926 and at the same time introduced Hollerith machines for processing policies as one of the first German companies to do so. The new technology was the prerequisite for these small policies to be offered at all. Since the relatively high processing costs could only be reduced to such an extent by using punchcard machines, the line, which was designed as funeral insurance with relatively low sums insured, could also work profitably in the long term.

After an initial dry spell in the area of small life insurance, the competitive advantage gained through technology finally manifested itself from 1930 onwards. A great contribution to this extent was the introduction of bridal dowry insurance.

1930

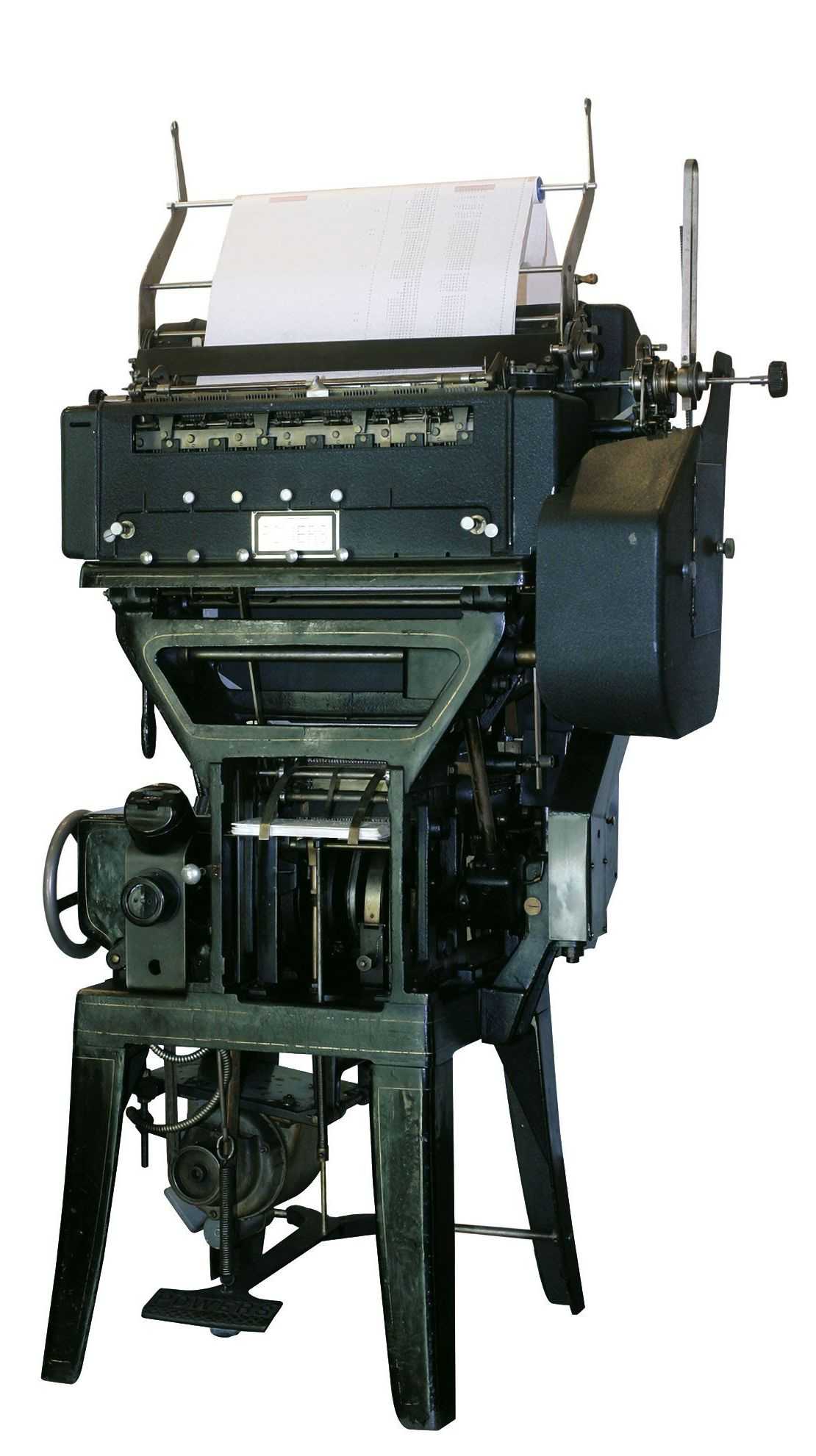

Punch card technology

Punch card technology first becomes the standard in the area of small life insurance, where cost-effective administration is particularly important. In 1930, Allianz Leben set up a punch card department in Stuttgart based on the model of the Berlin headquarters.

The punch card technology establishes itself

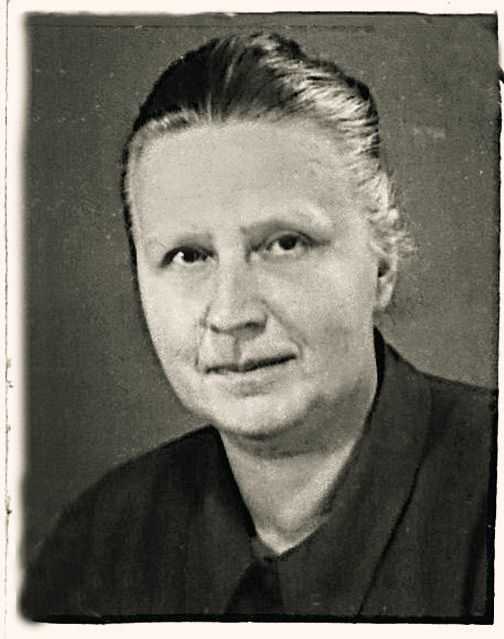

In the punch card department of Allianz, there were unprecedented opportunities for the advancement for women. The actuary Anna von Pritzbuer is an exceptional phenomenon: she came to Allianz in 1925, became head of the new punch card department at Allianz Leben, and in 1933 she was the first woman to be given power of attorney in the Hollerith department.

Source: BArch DC1/6979

What was typical of the rapidly developing Allianz Group between the 1930s to 1950s was the coexistence of punch card devices from competing manufacturers, which were soon also used for policy processing in the insurance industry. Stuttgarter Verein, which merged in 1927, and Frankfurter Allgemeine Versicherungs-AG, which was taken over in 1929, were already using punch card technology. At Frankfurter, the Powers punch card technology was initially established with 45-digit, only later with 90-digit punch cards. Already in 1926, a working group with Powers tabulation machines was set up to process premium invoices for burglary and theft insurance. In the 1930s and 1940s, Allianz used the tabulating machines from the German IBM subsidiary 'Deutsche Hollerith', initially the Type IIIB tabulating machine, then the BK, D9 and D11 devices, which worked with 80-digit punch cards.

© Sergei Magel/Heinz Nixdorf MuseumsForum

For some time, it looked as if Powers would be established alongside Hollerith at all Allianz locations, as it was compatible with the Adrema technology used at Allianz and the IBM system.

However, this approach was not pursued further after 1950 and was abandoned in favour of the idea of a group-wide standardization of the technical equipment and centralization at all locations. In 1954 the whole group switched to IBM machines.

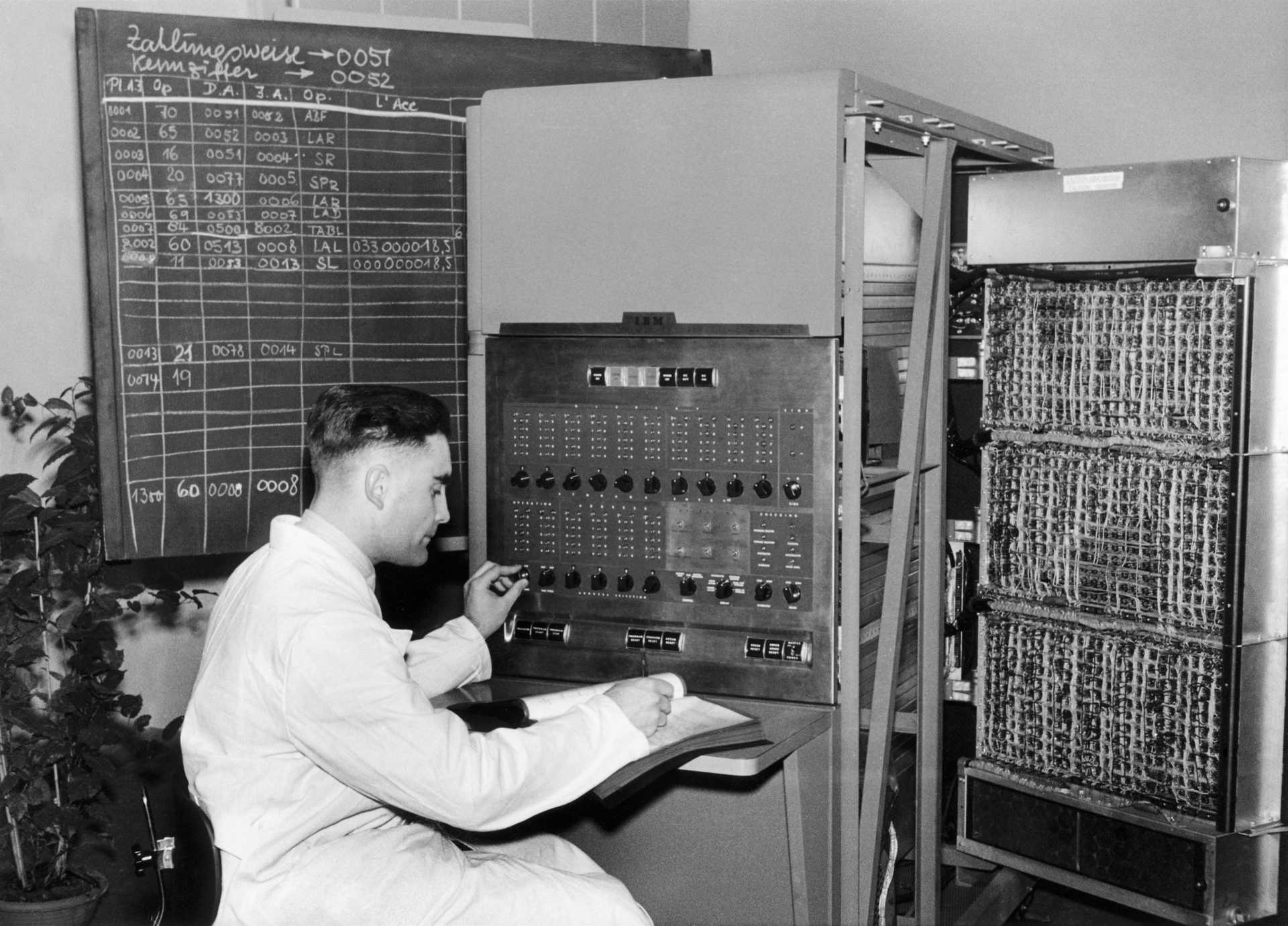

1956

EDP

On January 20, 1956, the age of electronic data processing began at Allianz. The company was the first European insurer to use the IBM 650 magnetic drum computer.

The start of electronic data processing at Allianz

It was a long road to the decision to buy a mainframe.

Heinz-Leo Müller-Lutz was a specialist in the organization of work, and founded the Business Management Department (BWA) at the headquarters in Munich in 1954. He recognized early how important rationalization would be for the long-term competitiveness of Allianz.

In the 1950s, Müller-Lutz put all the work processes in the company to the test. It was foreseeable that punch card technology would soon reach its limits due to the increasingly complex work processes and constantly increasing data volumes. As in the 1920s, rationalization had become necessary from an economic point of view. The goal was to achieve standardization and simplification of the processes using the most modern technology of the time.

For this purpose, a permanent team of business economists from the BWA and punch card specialists was formed in 1954 to examine the possibilities of using the electronic data processing system for Allianz.

The decision to acquire a mainframe was prepared intensively. Starting in 1952, Müller-Lutz learned from other insurers who were already working with computers during several study trips to the USA, Sweden and Switzerland.

At the end of 1954, the planning group suggested purchasing an electronic computer and in May 1955 one of the first series-produced IBM 650 magnetic drum computers was ordered.

When the IBM 650 was flown in from the USA on January 20, 1956, everything was prepared for its arrival: In 1955, Allianz founded a data center headed by Hans-Willy Schäfer to enable the use of the new mainframe computer. Before it was replaced in 1961 by the second generation of mainframe computers, 100 programs were written for the IBM 650, and it processed 80 million punch cards.

1969

Terminals

The IBM 2260 was the first terminal purchased by the data processing center (DVZ) in Munich in 1969. The device was used for entering and displaying data with a connection to the mainframe computer and access to the data from insurance contracts. This would streamline and speed up workflows considerably.

The introduction of terminals

The third generation of IBMmainframes (IBM/360) revolutionized inventory management from 1968 onwards. Saving an insurance portfolio on magnetic disks enabled access to the policy contract data in a matter of seconds. With these new terminals for data entry, it was possible to directly access the data on the mainframe in a decentralized way from the various Allianz locations in Germany over the course of the 1970s. The development from the first IBM 2260 to the comprehensive equipment of all office workplaces with terminals took a relatively long time. In 1969, six screens were installed at two subsidiaries in Munich and by the mid-1970s, 700 terminals were in use in offices throughout Germany. The area-wide equipment with terminals became a question of price, which was finally solved by the cheaper market newcomer ITT in 1983 with the "compact screen 3187".

From 1981 onwards, agencies were able to directly access their customers' data from the Allianz database via terminal, which was equipped with the Agent Information System.

The introduction of these technologies and their new possibilities also triggered scepticism among the employees about the massive upheavals and fears about the workplace.

The work of the punchers, who, as data typists no longer punched the information from the data templates into the punched card, but entered it via the keyboard and saved it on diskettes, became much more pleasant. Above all, this saved time and capacity in the further processing of data. An example: In payroll accounting, one hour of work on a computer could save up to 1500 hours of manual work. As early as 1972, it was clearly demonstrable that the number of employees needed could be reduced via IT, as considerably more employees would have had to have been employed in the 1970s in order to be able to cope with the growing business.

The screen soon became indispensable, and the days of the punch card finally came to an end in 1988.

1983

Personal Computer

It started as an experiment in 1983, when Allianz purchased the first personal computers (PCs) in both Stuttgart and Munich. It was unclear whether the employees would really need the PCs for individual data processing in the workplace. Few at Allianz foresaw the future importance of the PC for workers in the office and at home.

The use of the first PCs at Allianz

In the first half of the 1980s, data processing developed into a central factor in changing work processes and thus became a prerequisite for economic work and growth. Working with personal computers was very important.

The first models from Xerox and Apple were already on the market between 1974 and 1977, and IBM followed the sales success and brought out the first IBM PC (IBM 5150) in 1981. This set standards for further development and established the abbreviation PC.

The choice of Allianz to opt for the Columbia 1600-4 with a 10-digit MB hard drive in 1983 was due to the price. Columbia's error-prone hard drive made Allianz quickly switch to their traditional supplier of mainframe technology for PCs as well. In the meantime, IBM had brought out the successor model IBM XT (IBM 5160), a 16-bit computer, also with a 10 MB hard drive and with the PC-DOS operating system - largely identical to MS-DOS.

In the early years, the PCs were initially used in the office for calculations and data analyses, which could easily be converted into graphics and printed out. The number of devices increased rapidly, and in 1993 there were 1000 PCs installed at Allianz Leben. The conversion of computers from the DOS operating system to OS/2 by IBM in 1995 led to a massive infrastructure investment: 20,000 PCs were replaced or upgraded to prepare for the automatic installation of the multitasking operating system.

Only 10 years later the dimensions had changed completely once again: In 2005, there were 100,000 PC workstations at Allianz.

The field service also benefited from the suitability for everyday use of the individual data processing with simple applications for daily office work. The range and volume of work on the PC was constantly increasing and applications were being adapted at an ever faster rate.

Practical training courses were offered continuously for representatives. The sales force qualification seminars at the Stuttgart location, where representatives are trained by representatives, were presented as an example in a special issue of Allianz Magazine 2004.

1987

Mobile computers

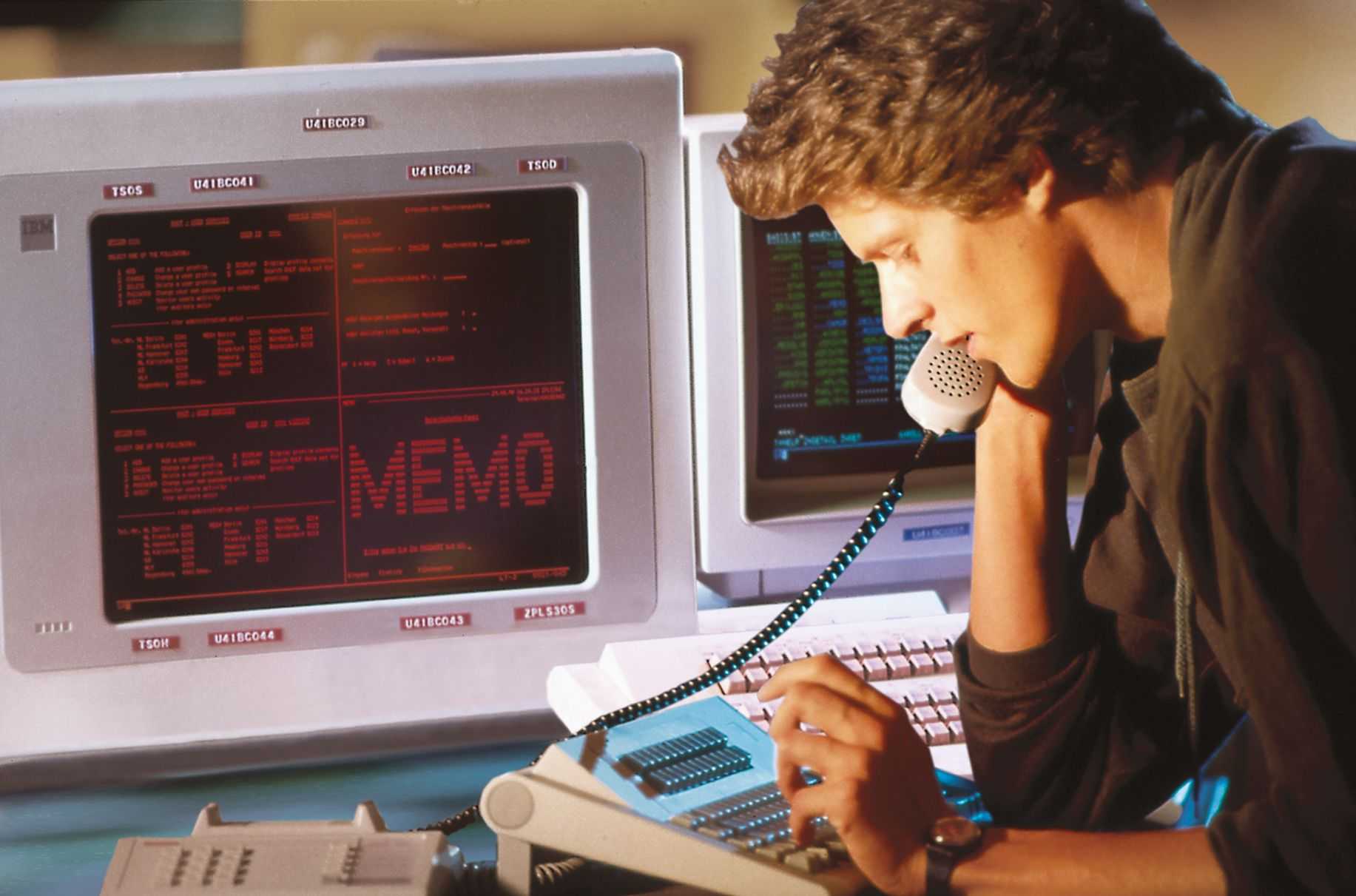

The idea of the mobile computer was put into practice by Allianz in the autumn of 1987. It should be able to communicate with the Allianz mainframe in every flat, in every repair shop and in every telephone booth via an acoustic coupler.

Mobile computers

It weighed 13.5 kilos and cost 9,100 DM (equivalent to nearly 9,000 euros). The road to the mobile computer at Allianz was paved with frighteningly large numbers. At the very beginning, there was a desire from sales and the automotive divisions for a portable PC that the field service employee, Hermann Schneider (pictured), could use to settle claims and advise customers. But how could a hacker be prevented from gaining unauthorized access to data in the data center via such a field service computer, or at least from penetrating as far as the programming interface of the IBM system at Allianz? The DVZ solved the security problem by inserting a front-end computer to which the user had to identify themselves with an individual ID card.

The first mobile computer was carried by Allianz employees into the living rooms of customers in the form of a heavy, black suitcase. Inside was a folding Nixdorf 8810 M15 computer with a 20MB hard drive, a built-in battery, an ink jet printer, and an acoustic coupler. The first five laptop pioneers at Allianz were able to set all this up in front of the amazed eyes of the policyholders during the experimental phase from summer 1989 and then get to work.

During the pilot phase, the testers had to struggle with a few early problems. Data transmissions to Allianz were frequently interrupted, there was no suitable word processing software, the templates for printable forms lacked the appropriate layout, and the arduous use of the “heavy laptop” was made even more difficult by the low contrast of the installed LCD monitor.

The employee magazine Allianz Journal reported almost reverently on the adventures that the laptop pioneer Bertram Peter from Aschaffenburg had to endure: “But a real computer freak, and you have to be like this as a pioneer for the use of laptops in the field, is not deterred by these shortcomings. In any case, Bertram Peter is enthusiastic and hopes that this will have a contagious effect on his colleagues.”

The mobile computer ushered in a new era of field work: Further, more user-friendly suitcase PC stations followed, such as the MoCoS with SNI computer (PCD 3Nsx/20) from 1991 and finally, from 1996 onwards, notebooks as part of the Agent Information System (VIS). These came standard with the Allianz Advisory Service program, which helped the agent determine their client's insurance needs, calculated tariffs and social security entitlements, and provided information data collection. In the course of the 1990s, mobile computer systems soon became standard equipment for the field service.

1995

Internet

When Marc Andreesen, the founder of Netscape, published the Mosaic web browser in 1993, a new era of communicaton started. In 1995 Allianz went online with its first own website.

The first internet presence of Allianz

In a relaunch on January 1, 1997, the first appearance was completely redesigned by the Allianz online project team. The layout was improved, the user-friendliness optimized and the appearance was registered under the domain www.allianz.de . The company used the possibilities of the internet to present itself and to engage in dialogue with the exploding number of users and customers. Here, Allianz presented the departments, divisions and products and advertised the work of the sales department with customer stories. The MEMO communication system which had been in use since 1984 - a first generation e-mail system - was connected to the internet in 1997. At the same time, Allianz Leben began to set up an intranet presence.

The next step wasn’t far: using the network for acquisition. First, selected agencies in a test field were given access to the internet and to a secure e-mail system for customer contact, as well as the so-called homepage assistant, in order to be able to set up their own agency presence.

The appearances of the Allianz companies and their parent company were regularly updated and expanded in the years that followed, and the blue-grey surface of the early years lead the way to a bolder color concept with strong colours that complemented the traditional blue in 2008.

Since global networking at group level was becoming increasingly important for the work of employees, the expansion of intranet communication started. Implementation of the intranet for Allianz Deutschland (IND) and the group-wide intranet platforms GIN (2002) or Connect for Allianz SE (2015) followed later.

1997

AGIS

Allianz Gesellschaft für Informatik Service mbH - AGIS for short - was founded on October 14, 1997. The signs pointed to change: It was about the industrialization of IT operations.

The founding of AGIS

In the autumn of 1997, the IT department at Allianz in Germany was fundamentally reorganized. From that moment, the newly founded AGIS managed the decentralized data processing systems, the computer centers and the system technology of the three IT units from the property, life and health insurance companies in Germany. The information systems (IS) department that remained with Allianz was responsible for IT strategies, controlling, data protection and application development as well as support for the office and field service.

This new bundling of tasks resulted in AGIS, an IT service company with more efficient operating processes and – due to its size – also more favorable conditions for hardware and software deliveries.

In the founding year, Ralf Schneider (AGIS) and Hans-Christoph Dölle (IS) started the mammoth of a project "Agency Management Information System" (AMIS) to significantly improve the IT support of the field service. And that was just the beginning. In the course of the next few years, centralization, standardization and automation with the aim of industrializing IT operations was a constant concern.

For example, the restructuring program in the course of the merger of AGIS with the IT service company of Dresdner Bank after their takeover (2001) and the conversion to the "new AGIS". Other centralization milestones include the closure of seven German data centers and the relocation of the mainframe to Munich in 2006.

While the work of AGIS was still geared towards the German-speaking companies, the successor company ASIC developed from 2008 into the European IT infrastructure provider for the Allianz Group, which then globalized to become Allianz Managed Operations & Services (AMOS) in 2010.

2003

ACIS

The Allianz Group company in the UK established Allianz Cornhill Information Services (ACIS) in Trivandum, India, as a software developer.

Allianz Cornhill Information Services was established in India

Since the labor costs in India were significantly lower than in the UK, and there were many highly qualified young IT professionals there, Allianz Cornhill decided in 2003 to set up a software developer in India. Initially, 20 IT specialists worked for ASIC, but very soon the range of tasks expanded to include tasks in IT service and support, in payment processing and in claims processing and policy administration. After five years, 600 employees were already working for ASIC.

In February 2012, AMOS, Allianz SE's IT service provider, also founded a branch in India, thereby underpinning its own claim to be the key enabler of the digitalisation of IT infrastructure and applications for Allianz worldwide.

In 2017 at the latest, with the acquisition of ASIC by Allianz Technology, the subsidiary in India rose to become one of the central IT locations of Allianz.

2006

ABS

Allianz begins to set up the uniform IT system ABS (Allianz Business System) for the newly created Allianz Deutschland AG, after the model had previously been successfully introduced in Austria.

Allianz Business System

The work was geared towards the goal of establishing a uniform IT system for the newly created Allianz Deutschland AG. Until that moment, a multitude of different applications had existed side by side in the different German companies, and IT systems that spanned the entire company were the exception. This then changed: The number of components was reduced and the entire application landscape became more manageable and homogenous. The introduction of ABS marks a turning point in the company's development.

The model includes three elements: In the first step, all customer correspondence is scanned so that the clerk can process the documents digitally. Secondly, central call centers with a single telephone number take over customers' calls. The employees trained for this activity are to conclusively clarify as many enquiries as possible. Only if this is not possible will the request be forwarded to the person in charge. Thirdly, the target operating model means that for the first time a system is created that includes all customers and all offers, so that the person in charge can see the customer in all his contractual relationships and with all available information.

More and more business areas and products in Germany were gradually mapped in ABS, for example the new insurance product "My Car" in 2011. Internationally operating Allianz companies soon benefited from ABS as well. In 2012, for example, Allianz Global Assistance was able to introduce improved B2B2C functionalities for travel insurance worldwide, thus harmonising products and business processes. The many projects that were now starting soon threatened to overwhelm the few ABS experts at Allianz. The ABS Academy, founded in 2013, provided a remedy. Their head, Brit Fiedler, promised to all those who still had to wait for ABS: “Now we're training as many employees as we need." By 2018, Allianz managed 42 million policies in 15 countries with ABS.

2007

ASIC

Allianz founded the new company Allianz Shared Infrastructure Services (ASIC), to combine the IT infrastructures, mainframes and servers, of initially 15 European subsidiaries, which had 26 IT units, each with different processes, products and technologies.

With ASIC to Europe

In 2007 and 2008, Allianz set the course towards more uniform, international and cost-efficient information technology. ASIC was initially established as a limited liability company and was incorporated as a European Company in 2008. Markus T. Müller took over as Chairman of the Management Board, while Oliver Bäte chaired the Supervisory Board.

ASIC was given an ambitious programme that would soon also meet the requirement of a real Europeanisation of IT when, as early as 2008, its field of work was extended to include the information technology of the Allianz companies in Central and Eastern Europe. ASIC took an alternative route in its cooperation with the Allianz subsidiary in France AGF: Parts of AGF Informatique and the data center there were integrated as a second production site. With the objective of bringing the cost and quality of its services to a generally competitive level by 2010, ASIC focused on the following areas of work: It developed and operated the IT infrastructure and maintained and operated the information systems in the Allianz Group. It developed, installed and operated market-proven IT technology for mainframes, server systems and networks. It also offered services in the area of consulting, projects, application & data services and printing and was responsible for IT security.

ASIC concluded a contract with Fujitsu for workplace services, networks and telecommunications as part of the outtasking process. This company, as the service provider, took over responsibility for the entire work area and eventually also around 500 Allianz employees who had previously been AGIS or ASIC employees.

As soon as the employees' rights of co-determination were affected by the far-reaching changes in the world of work, the management and the human resources department worked closely with the works council. The photo shows Markus T. Müller in a conversation with employee representatives Jürgen Lawrenz, Manfred Büttner and Helmut Eckelt at the "ASIC inside Round Table".

2010

AMOS

Allianz founded Allianz Managed Operations and Services (AMOS) with the task of being responsible for Allianz's IT worldwide and thus making a decisive contribution to making Allianz a digital company.

The founding of AMOS

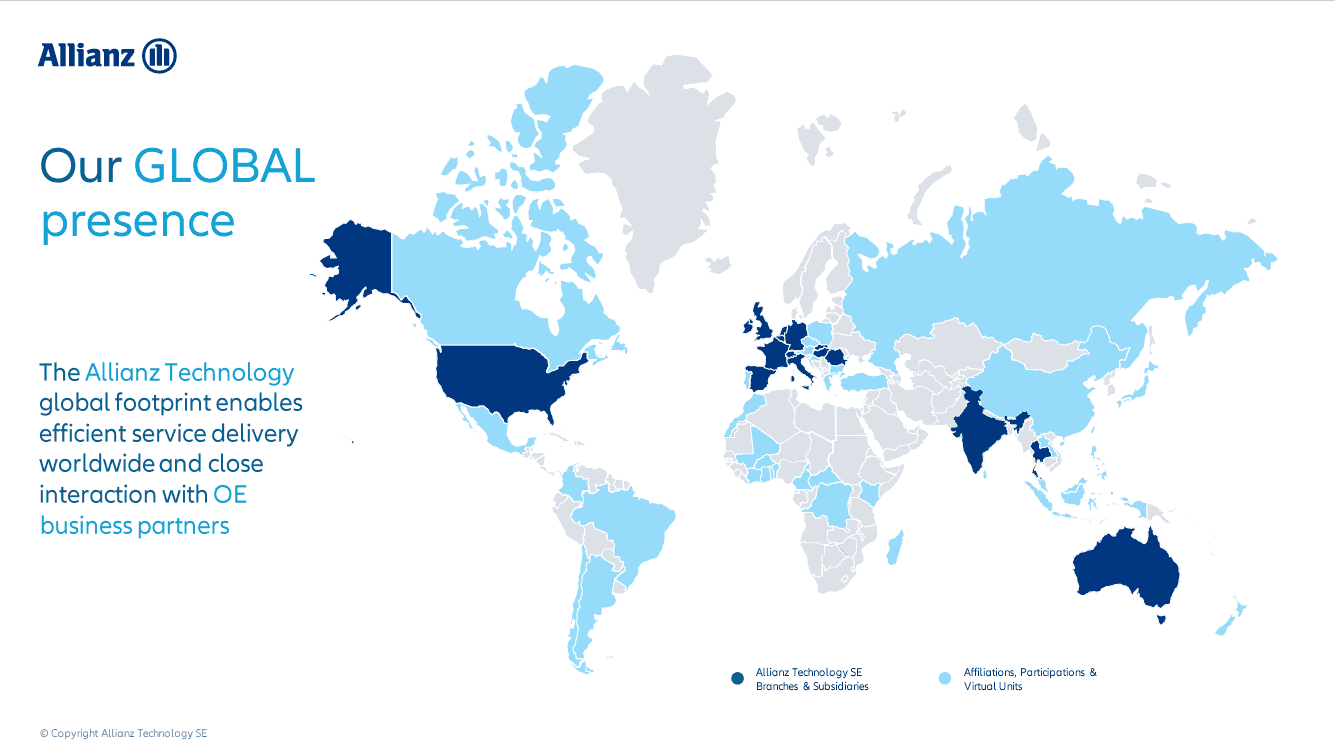

AMOS developed dynamically, both in terms of the volume of business and the number of employees. The strong growth of AMOS was largely based on consistently continuing along the path of internationalization that ASIC had already taken: At the end of 2011, AMOS already had six branches in Belgium, Great Britain, Ireland, the Netherlands, Switzerland and Singapore, as well as a subsidiary in Austria. Finally, in February 2012, a new branch was established in India, further underpinning AMOS' claim to be the key enabler of the digitalisation of IT infrastructure and applications for Allianz worldwide. At the latest in 2017, with the acquisition of the IT subsidiary of Allianz Cornhill, ACIS India, the branch office in India rose to become one of the central locations.

2013

IT transformation

The transformation program is intended to make Allianz infrastructure highly available, high-performing, highly secure and resilient as well as agile in four years and is considered the most comprehensive IT renewal that Allianz has ever seen.

The launch of the Allianz IT Infrastructure Transformation Program

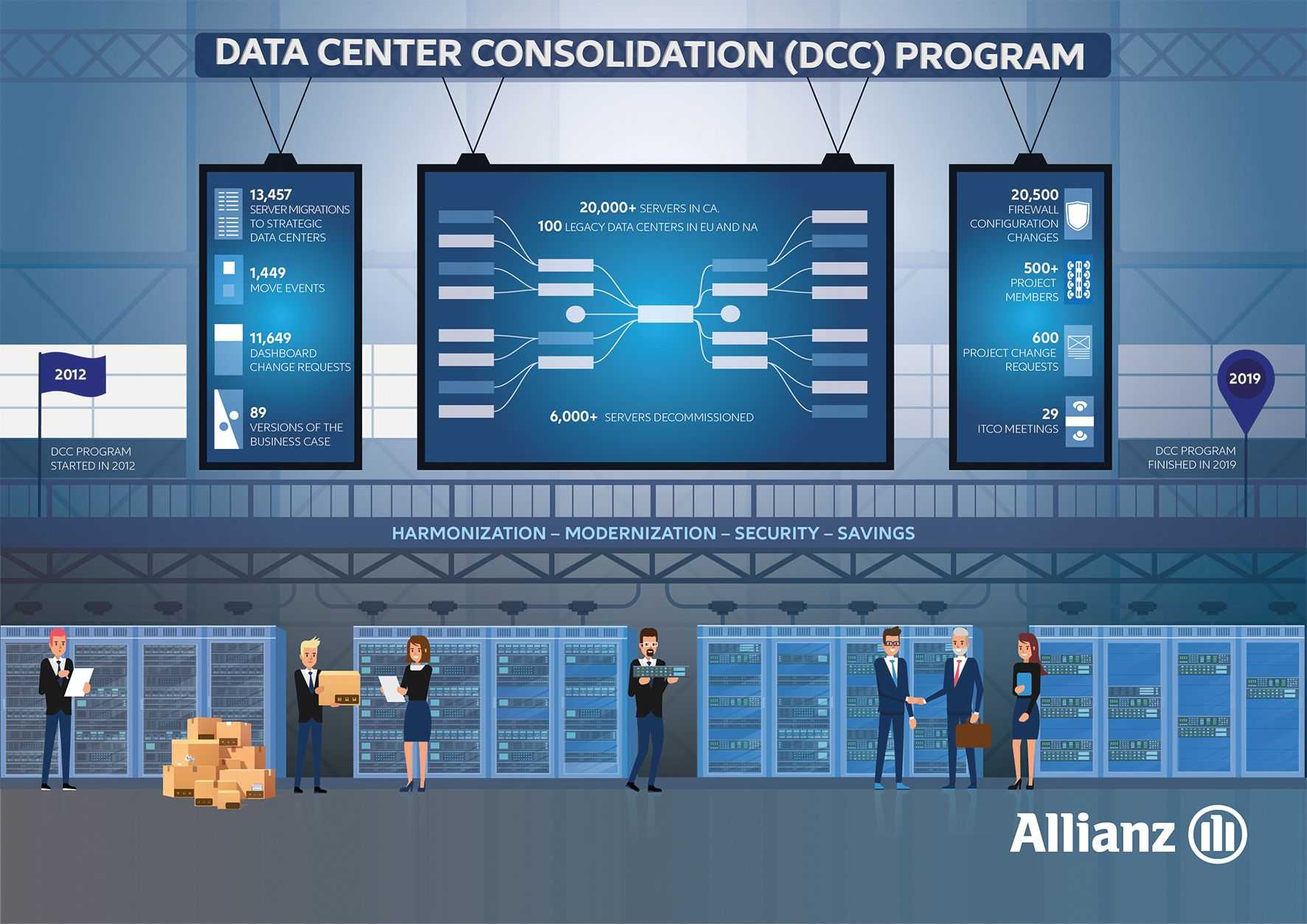

The Allianz IT Infrastructure Transformation Program (AIT) created the technical prerequisites for the digitalization of central work processes at Allianz and consisted of four individual projects: Allianz Global Network (AGN). Data Center Consolidation (DCC), Allianz Virtual Client (AVC), and Information Security. AGN transformed the fragmented network landscape of the OEs into a unified Allianz-owned high-speed highway for data and voice.

DCC reduced the 140 data centers to just six. AVC created a highly flexible, virtual work environment and enabled employees to work at any time, anywhere, and with any device with internet access. All of this was flanked by measures to protect sensitive data from cyber attacks and theft and to comply with increasingly strict data protection laws.

2017

Allianz Technology

After a company-wide vote by the employees, AMOS was renamed "Allianz Technology".

A new name: Allianz Technology

Before Allianz bought its first computer in 1956, it set up the computer center as a new department, initially with two employees. The division grew quickly and changed its name almost just as quickly: DVZ, AGIS, ASIC, AMOS. All these designations had one thing in common: they were abbreviations and anything but self-explanatory. After a good 60 years, when the IT subsidiary of the Allianz Group was given a new name, that was about to change.

For the first time in the history of Allianz, the employees themselves determined the name of their company. Together, more than 250 colleagues had first developed a short list of new names themselves before all employees could vote at the intranet platform Allianz Connect. A majority of the approximately 4,000 employees at the time ultimately voted in favour of "Allianz Technology".

2018

Allianz Customer Model

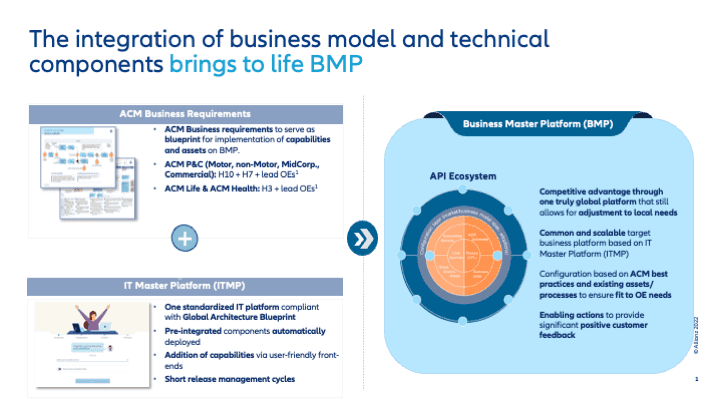

The Allianz Customer Model and the IT Master Platform will be standardized and further developed into the overarching Business Master Platform (BMP) of Allianz.

Business Masterplattform

Since 2013, in the course of the Allianz Infrastructure Transformation, Allianz became increasingly digital and the IT global. In 2018, the entire digital business of Allianz Group will be merged into a new board of directors under the new Chief Business Transformation Officer, Iván de la Sota. This will further accelerate the transformation process and the systems will develop significant synergy effects and save costs.

What is fundamentally new is that this unit was created to develop and introduce group-wide strategies for digital business and their implementation by IT. It is about creating a digital business model that focuses on the customers and not the product and, thanks to a modular approach, is able to better respond to their needs.

The existing Allianz Customer Model and the IT master platform will be standardised and further developed into the overarching business master platform of Allianz. This provides all companies of Allianz with a product with the same product architecture worldwide that allows local adaptations.

2020

Covid 19

The globally uniform IT infrastructure enables employees to work from home and Allianz crisis-proof business operations.

The Covid 19 Pandemic

Digital transformation at Allianz is ongoing. However, in 2020 it proved that the enormous efforts of the last few years are bearing fruit: When Allianz employees worked from home after the outbreak of the COVID-19 pandemic, it was remarkable how quickly and how smoothly the switch to the home office worked. The pictures by Matthew Winterer, Patthisar Yingsawat and Rachanon Kratudngern impressively show the many challenges that employees had to and still have to face when working from home.

The vision from 2011, "Anytime, anywhere and with any device" has now truly been implemented. The good infrastructure and dedicated staff thus ensured the almost smooth continuation of business operations and ensured that Allianz was able to settle insurance claims quickly and reliably even during the Corona crisis.

Allianz publicized the successes already achieved on the way to becoming a digital company by being one of the first DAX companies to hold a purely virtual general meeting on May 6, 2020, thus helping to protect shareholders and employees. The approximately 9,000 employees of Allianz Technology made this success possible.